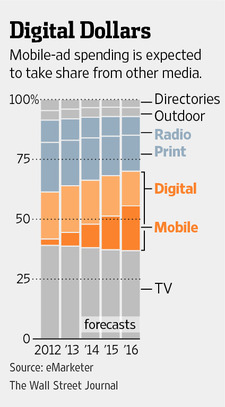

But given how much time Americans spend on their devices, mobile-ad spending could be much higher, an indication that marketers remain uncertain about the medium’s effectiveness.Research firm eMarketer estimates that spending on mobile advertising, which includes both smartphones and tablets, will soar 83% to nearly $18 billion in 2014. Newspapers will draw nearly $17 billion, while radio will bring in $15.5 billion.

But given how much time Americans spend on their devices, mobile-ad spending could be much higher, an indication that marketers remain uncertain about the medium’s effectiveness.Research firm eMarketer estimates that spending on mobile advertising, which includes both smartphones and tablets, will soar 83% to nearly $18 billion in 2014. Newspapers will draw nearly $17 billion, while radio will bring in $15.5 billion.

“As more eyeballs are going there in larger numbers, the dollars are starting to follow,” said Cathy Boyle, an eMarketer mobile analyst.

Still, the imbalance remains stark: American adults now spend almost a quarter of their media time on mobile devices, eMarketer estimates, yet this year’s spending growth will raise mobile’s share of the ad market to only 9.8%. By contrast, American adults spend only 2% of their media time reading newspapers but ad spending for the sector hangs just under 10% of the overall market, eMarketer estimates.

Print’s resilience reflects marketers’ preference for what they know, industry analysts say, and impact among certain retailers and luxury goods.

Radio’s share of the ad market has been eroded slightly in recent years, dropping to 8.6% this year from 10% in 2008, according to eMarketer. Television draws about 40% of adult media time and the same proportion of the ad market.

That mobile still draws a far smaller share of the ad market than of consumers’ media time reflects advertisers’ slowness to change, analysts say, as well as their unhappiness with mobile ad formats. A variety of new ad products for mobile have emerged recently that is helping jumpstart ad spending.

“Historically we’ve had these really basic, tiny little banners that were more of a nuisance,” said Angela Steele, chief executive of Ansible Mobile, a mobile-marketing firm owned by Interpublic Group of IPG -0.25% Cos. Now marketers have more options, like “native” ads that appear in stream and look like a publishers content or ads that prompt readers to go right to the app store and download a game, Ms. Steele says.

Questions about the effectiveness of mobile advertising persist. EMarketer polled a dozen marketers and digital ad experts, who gave the effectiveness of mobile display ads a “B-.” Other mobile ad formats fared better, like location-targeted ads, which received an “A-.”

“The location capabilities inherent in mobile are a big factor driving a lot of ad revenue into the mobile space,” Ms. Steele said. Marketers are excited about the idea of being able to serve ads on the smartphones of shoppers within the radius of a particular store, for example.

Other media isn’t giving up their fight for dollars. Longtime radio executive Jeffrey Schwartz, executive vice president of Yahoo Sports Radio, says that older platforms still have use to advertisers.

“Is radio going to grow? No,” said Mr. Schwartz, whose company provides radio programming. “Is radio going to maintain? Probably for a while—and let’s revisit this story in three years.”

Indeed, a recent study from Nielsen Catalina Solutions found that each dollar of advertising spending on radio averaged a sales return of $6 from listeners in the 28 days following when they heard the spot.

“It’s actually quite effective in driving sales,” Randall Beard, global head of advertiser solutions at Nielsen, said of radio advertising.

Those in the ad industry say that mobile still faces a challenge in measuring its audience. Nielsen and comScore have been in a heated battle to deliver tools to marketers to do just that.

“The big question that advertisers have is how do I allocate my ad spending across platforms?” said Mr. Beard. “How much do I put online, into TV, and tablet and smartphone? To be able to answer that effectively you have to know what kind of audiences you’re reaching.”

As the measurement tools develop, industry experts say marketers will become increasingly comfortable with shifting more money to mobile.

“I think it’s going to take a very big bite out of all the advertising dollars,” said Yariv Ron, chief executive of mobile ad company Appwiz. “The infrastructure is not there yet. Only now is it starting to take form and shape.”

Mr. Schwartz says he’s heard the line about media outlets petering out before. With TV, “How many people had networks dying when cable came on?” Mr. Schwartz said. “It didn’t die.”

As for digital competition, he isn’t concerned. “I can’t give a damn about the streamers and the mobile people,” he added.

Write to Steven Perlberg at steven.perlberg@wsj.com